Input Tax Credit - ITC

INPUT TAX

CREDIT

When we purchase goods we pay Input GST to dealer and

when we sell the same then we collect output GST from customer. So when we pay

Taxes to Tax Authorities, we deduct the one we paid during purchase this is

called Input Tax credit . Means while paying tax we don't pay whole amount

collected from customer but the difference between output GST(GST collected

from customer while selling the goods) and Input GST (GST paid to dealer while

purchasing goods), this adjustment is called Input Tax Credit.

Let us understand the same with the help of

following illustrations

|

| Input Tax Credit ITC |

Who

can claim ITC

ITC can be claimed by a person registered

under GST only if he meets ALL the conditions mentioned

below.

a. The dealer should have tax invoice

b. The said goods/services have been

received

c. Returns have been filed.

d. The tax collected has been paid to the

government by the supplier.

e. When goods received in installments, Input

Tax Credit can be claimed only after the last lot is received.

f. If depreciation has been claimed on tax

component of a capital good, No ITC will be allowed

Note:

Business registered under composition scheme in GST cannot claim ITC.

Input Tax Credit can be claimed only for business purpose Transactions.

ITC will not be available for goods or

services specifically used for:

a. Personal use

b. Exempt supplies

c. Supplies for which ITC is not available

How

to claim ITC

All regular taxpayers must file the amount

of input tax credit(ITC) in their monthly GST returns in the Form GSTR-3B. Table

below shows eligible ITC, Ineligible ITC and ITC reversed during the tax

period.

Reversal

of Input Tax Credit

ITC can be availed only on goods and

services for business purposes. Apart from these, there are certain other

situations where ITC will be reversed.

ITC will be reversed in the following

cases-

1) Non-payment of invoices in 180 days

2) Credit note issued to ISD by seller

3) Inputs partly for business purpose and

partly for exempted supplies or for personal 4) Capital goods partly for

business and partly for exempted supplies or for personal use

5) ITC reversed is less than required

Reconciliation

of ITC

ITC claimed by the person has to match with

the details specified by his supplier in his GST return. In case of any mismatch, the supplier and

recipient would be communicated regarding discrepancies after the filling of

GSTR-3B.

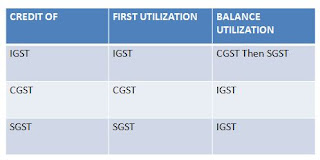

How

to utilize the Input tax credit

In

GST we have three types of taxes CGST, IGST, and SGST/UTGST.

IGST is applicable for the inter-state supply of goods/ services.

and for the intra-state supply of goods/services both CGST and SGST/UTGST are charged.

IGST is applicable for the inter-state supply of goods/ services.

and for the intra-state supply of goods/services both CGST and SGST/UTGST are charged.

While payments are made for these taxes,

input tax credit will be allowed in the following manner

Comments

Post a Comment